Managing payroll is one of the biggest and most important responsibilities of any business. Failure to handle payroll, tax withholding, and time off properly can lead to employee dissatisfaction and legal troubles.

At CMP, we help our business clients by providing payroll services and making recommendations about the best tools to use for in-house payroll. With that in mind, here are our recommendations for 10 top payroll software solutions to help you keep your payroll in good order.

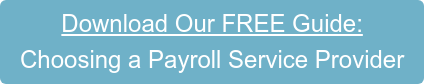

1. Gusto

Gusto is a cloud-based payroll software that’s affordably priced and offers some great features. It can:

Gusto is a cloud-based payroll software that’s affordably priced and offers some great features. It can:

- Automatically calculate the proper withholding for your local, state, and federal taxes

- Submit your taxes to ensure that you are always in compliance

- Add new employees and remove employees who have left your company

- Track employee hours

- Track employee time off and salary changes

In addition to payroll services, Gusto has the ability to perform other HR services, including tracking benefits and workers’ compensation administration. The company offers a one-month free trial period. After that, prices start at a base price of $39 per month plus $6 per employee. Click here to learn more.

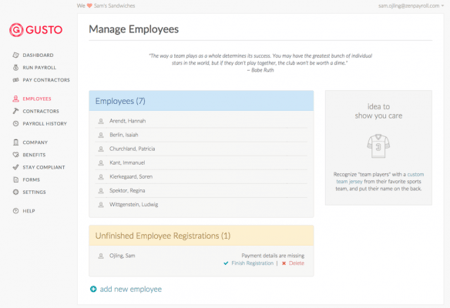

2. OnPay

Like Gusto, OnPay is a cloud-based payroll solution. It offers a wide range of payroll and related capabilities, including:

Like Gusto, OnPay is a cloud-based payroll solution. It offers a wide range of payroll and related capabilities, including:

- Automated tax filing and payments

- Online employee self-service

- 401K and workers’ compensation administration

- Unlimited online payroll runs, including payments to 1099 contract workers

- Direct deposit, pay card, and check options

There is a free, one-month trial of OnPay available, so you can try the software for yourself and compare it to your existing payroll solution. After that, they charge one low fee for everything. The base price is $36 per month, and then you’ll pay an additional $4 per month per employee. Click here to learn more.

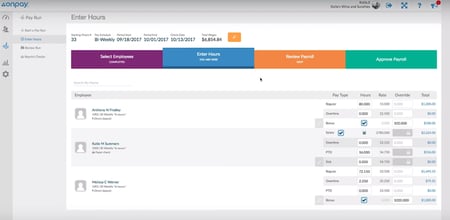

3. Paycor Perform

Our  third choice is Paycor Perform, a comprehensive cloud-based payroll tool with an easy-to-use interface and affordable pricing. Here’s some of what you can do with Paycor:

third choice is Paycor Perform, a comprehensive cloud-based payroll tool with an easy-to-use interface and affordable pricing. Here’s some of what you can do with Paycor:

- Creative intuitive payroll and workflow processes

- Integrate seamlessly with your general ledger

- Empower employees through self-service access

- Calculate and pay local, state, and federal taxes

- Create on-demand reports and analytics

Paycor also offers comprehensive HR software, including time tracking and attendance. Pricing is based on your specific needs, but you can learn more and get a free demo of Paycor by clicking here.

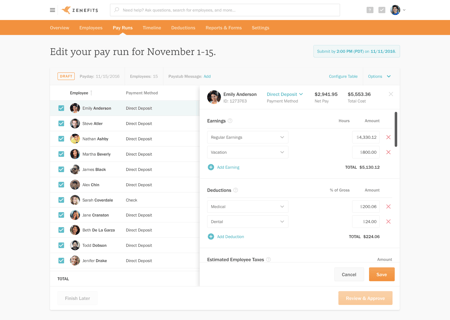

4. Zenefits

Zenefits is unique among payroll software companies, offering extensive partnerships with other apps and software for easy integration with your existing HR solutions. Here’s some of what they offer:

Zenefits is unique among payroll software companies, offering extensive partnerships with other apps and software for easy integration with your existing HR solutions. Here’s some of what they offer:

- Integration with Google, Office 365, Asana, Salesforce, and many more of your favorite office solutions.

- Easy HR management that allows you to push raises, bonuses, and expenses directly into your payroll.

- Tracking, management, and payment of all local, state, and federal payroll taxes.

- Access to a team of HR professionals and an extensive library with answers to your most common payroll and HR questions.

- Payroll, HR, and related apps to add on.

The Standard Plan costs $40 plus $5 per employee per month. The Advanced Plan is $40 plus $9 per employee per month and includes expanded compliance and HR capabilities. You can learn more here.

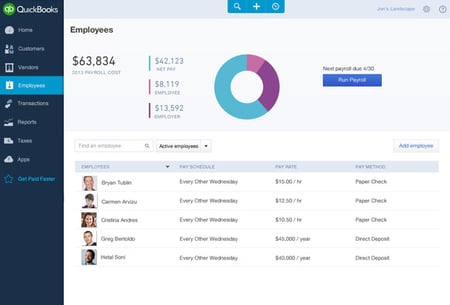

5. Intuit Payroll

Intuit is the payroll solution from top accounting software firm QuickBooks. In addition to integrating fully with QuickBooks, Intuit can:

Intuit is the payroll solution from top accounting software firm QuickBooks. In addition to integrating fully with QuickBooks, Intuit can:

- Calculate your local, state, and federal payroll taxes

- Accumulate information for you to file – or handle the filing for you

- Track employee hours and time off

- Manage benefits and workers’ compensation

Intuit also offers a penalty-free guarantee and a free app, so you can easily handle your payroll even when you’re traveling. They have a 30-day free trial. After that, the self-service plan is $17.50 per month plus $4 per employee per month, and the full-service plan is $40 plus $4 per employee per month. Click here to learn more.

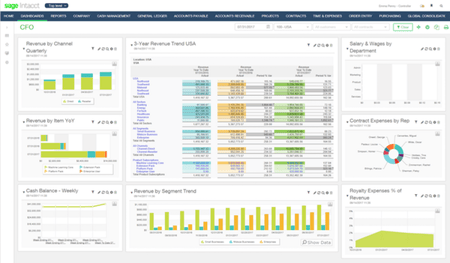

6. Sage Intacct

Sage Intacct is a little different from the other options on our list because it’s technically not payroll software. It is Enterprise Resource Planning software. However, we’re including it because it does a good job with payroll and may be ideal for companies in search of ERP. Here are some of its features:

Sage Intacct is a little different from the other options on our list because it’s technically not payroll software. It is Enterprise Resource Planning software. However, we’re including it because it does a good job with payroll and may be ideal for companies in search of ERP. Here are some of its features:

- Easy-to-use dashboard where you can manage every aspect of your business

- Simple tracking of payroll, taxes, commissions, and insurance for every employee

- Core accounting capabilities

- Built-in and customizable reports

Because Sage Intacct is an ERP, the pricing is higher than the other software we’ve included here. The plan for small businesses' payroll starts at $400 per month. You can learn more by clicking here.

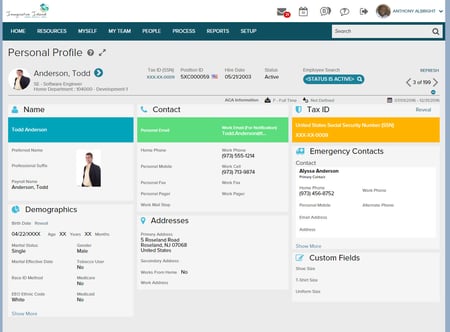

7. ADP Workforce Now

ADP Workforce Now is web-based HR software that includes options for managing payroll. It’s made by Automatic Data Processing. Here are some of its key capabilities and features:

ADP Workforce Now is web-based HR software that includes options for managing payroll. It’s made by Automatic Data Processing. Here are some of its key capabilities and features:

- Robust benefit management features, including a benefit plan creation wizard

- Compliance with local, state, and federal payroll taxes, as well as IRS forms 1094 and 1095

- Management of payroll, bonuses, benefits, commissions, and more

- Real-time analytics and ad hoc reports

The pricing for ADP Workforce Now has three tiers based on the size of your company. You’ll be able to choose from Small Business (1-49 employees), Mid-Sized (50-999 employees), Large (1,000+ employees), or Multinational (Any size). You can learn more here.

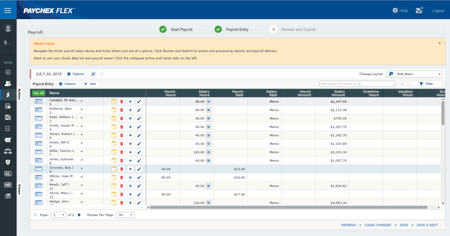

8. Paychex

Paychex is a payroll software program that has a large client base and offers a menu of common-sense payroll and HR capabilities. Here are its key features:

Paychex is a payroll software program that has a large client base and offers a menu of common-sense payroll and HR capabilities. Here are its key features:

- Payroll information can be accessed via the web, email, phone, or manually.

- Guaranteed compliance with local, state, and federal payroll tax requirements.

- Expense management and online benefits management.

- Access to a library of webinars, articles, videos, blue papers and more that cover everything about the platform as well as hiring, HR services, compliance, and online recruiting.

The pricing for Paychex is tiered based on the size of your company, and the general brackets are Small (under 10 employees), Medium (10-49 employees) and Large (50-1,000+ employees.) You can learn more on their website, here.

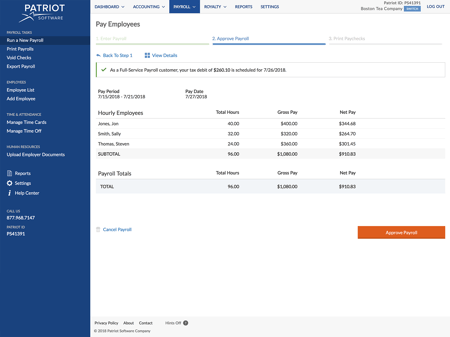

9. Patriot Payroll

Patriot Payroll makes our list because it’s easily one of the most affordable basic accounting and payroll systems on the market. Here’s some of what you can expect:

Patriot Payroll makes our list because it’s easily one of the most affordable basic accounting and payroll systems on the market. Here’s some of what you can expect:

- Choose between basic and full-service payroll

- Easy to use for business owners with no accounting or payroll experience

- Manage employee hours, time off, and benefits all in one place

- Printable W-2s to distribute to employees

You can choose between the Basic Plan and the Full-Service Plan. The Basic Plan costs $10 per month plus $4 per employee per month. The Full-Service Plan is $30 per month as a base, plus $4 per employee per month. There’s a 30-day free trial available, and you can learn more by clicking here.

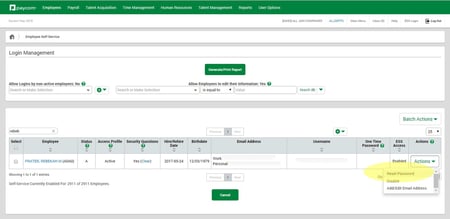

10. Paycom

Our final payroll software is Paycom, which, like the others on this list, is cloud-based. Here are some of its core capabilities:

Our final payroll software is Paycom, which, like the others on this list, is cloud-based. Here are some of its core capabilities:

- Tracking and automatic debits of all local, state, and federal payroll taxes

- Track employee hiring, management, and reviews

- Single database platform that syncs new data automatically

- Personalized service with a dedicated account manager

Paycom’s services are tailored to the size and specific requirements of your company. You can click here to learn more or set up a meeting.

Conclusion

The ten payroll software products we’ve reviewed here are sure to include something that will work for your company. You may choose to start with a price comparison before moving on to a review of specific features and capabilities.

Beyond cost, knowing which service will best cover the needs of your business and best protect against potential issues can take a discerning eye. All of these services are excellent, and the experts at CMP can help you find the right one for any payroll or HR needs you may have.

Want to learn more about our payroll and bookkeeping services? Give CMP a call today: We have two offices to serve you: Logan, UT – 435-750-5566 and Salt Lake City, UT – 801-467-4450.