Business owners have many responsibilities, and filing corporate taxes could be one of the most important. We get it - Form 1120 can be confusing, and mistakes can lead to penalties, audits, or unnecessary stress. Whether you're filing for the first time or are simply looking to understand the requirements better, we’ve got you covered.

At CMP, we take our responsibility of ensuring tax compliance with our clients seriously. We understand how complex corporate tax rules can be and are here to help simplify them.

If your business is a C-corporation or an LLC taxed as a corporation, filing Form 1120 is mandatory even if you have no income. The IRS enforces strict filing deadlines, and failure to meet them can result in penalties.

In this guide, we’ll break down what Form 1120 is, who needs to file it, and how to complete it correctly so you can avoid mistakes and stay in good standing with the IRS.

What Is Form 1120?

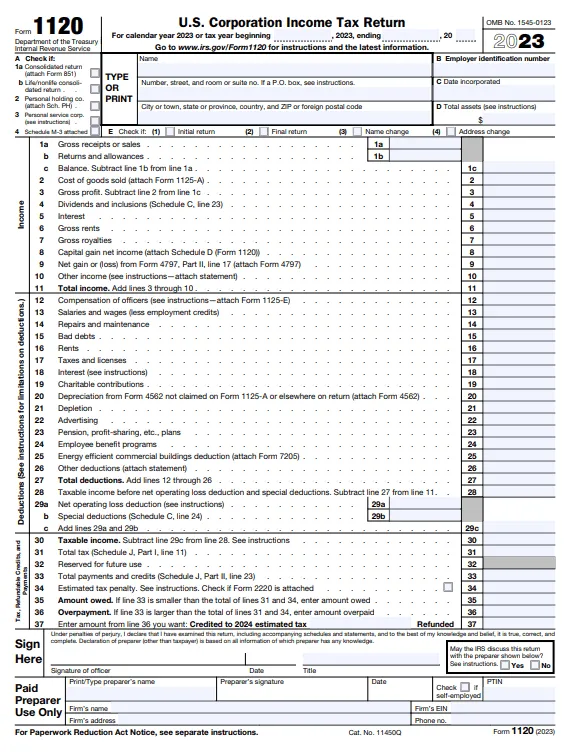

Form 1120 is an IRS tax form that corporations use to report their income, deductions, and tax liability. It is also known as the Corporation Income Tax Return and is required for C-corporations and certain other entities taxed as corporations.

A C-corporation operates as a separate legal entity, which means it pays taxes at the corporate income tax rate instead of passing income through to its owners. The corporate tax rate remains a flat 21%.

Corporations use Form 1120 to calculate their tax bill. Even if a corporation had no income for the year, filing the form is still required to comply with IRS regulations.

Who Needs to File Form 1120?

Corporations and certain business entities are required to file Form 1120 to report their income, deductions, and tax liability to the Internal Revenue Service (IRS). Even if a corporation has no taxable income for the year, it must still file the form to maintain compliance.

Businesses that must file Form 1120 include:

- C-Corporations – All domestic C corporations, regardless of income, must file Form 1120.

- LLCs taxed as corporations – If an LLC has elected to be taxed as a corporation by filing Form 8832, it must also file Form 1120.

- Farming corporations – Agricultural businesses structured as corporations must report their financials using Form 1120.

- Corporations with ownership in a FASIT – Businesses holding an interest in a Financial Asset Securitization Investment Trust (FASIT) are required to file.

Foreign-owned domestic disregarded entities – If a U.S. entity is wholly owned by a foreign corporation or individual, it must file Form 1120 and attach Form 5472 for reporting transactions with its foreign owner.

Who Is Exempt from Filing Form 1120?

- S-Corporations – These entities file Form 1120-S instead.

- Tax-exempt corporations – Nonprofits and other entities that qualify for Section 501(c) tax exemption generally file Form 990 instead.

- Partnerships and single-member LLCs – These entities typically report income on Form 1065 or the owner’s personal tax return.

For businesses unsure of their filing requirements, CMP provides expert tax guidance to ensure compliance and minimize tax liability.

What Information Is Included in Form 1120?

Here’s a breakdown of the main sections in Form 1120:

1. Business Information

This section includes essential details about the corporation, such as:

- Employer Identification Number (EIN)

- Date of incorporation

- Principal business activity and product/service

- Total assets

2. Income

This section reports all sources of the corporation’s revenue, including:

- Gross receipts or sales from primary business activities

- Returns and allowances, subtracted from gross receipts

- Capital gains and losses

- Other income, such as dividends, interest, rents, or royalties

3. Deductions

Here, the corporation reports deductible business expenses, such as:

- Cost of goods sold (COGS)

- Salaries and wages

- Rent, utilities, and office expenses

- Repairs and maintenance

- Interest expenses

- Charitable contributions

- Depreciation and amortization

4. Tax Computation

This section determines the corporation’s taxable income and tax liability:

- Taxable income is calculated by subtracting total deductions from total income

- The corporate tax rate (currently a flat 21% for corporations) is applied to taxable income

- The final tax amount is determined before any credits are applied

5. Credits

Tax credits can reduce the total tax due, including:

- General business credit

- Foreign tax credit

- Credit for federal tax paid on fuels

6. Other Taxes

Additional taxes that may apply to corporations are reported here, such as:

- Recapture taxes (e.g., for investment tax credits)

- Base Erosion and Anti-Abuse Tax (BEAT) — Applies only to large multinational corporations. The rate is scheduled to rise to 12.5% for tax years beginning after December 31, 2026.

Note: The traditional corporate AMT was repealed for tax years beginning after December 31, 2017. However, a new corporate minimum tax (corporate AMT/CAMT) is effective for large corporations for tax years beginning after Dec 31, 2022. The IRS released Notice 2025-27 providing interim guidance for tax years beginning after Dec 31, 2024. Small-business C-corporations typically won’t be subject to CAMT, but they should stay alert for how future IRS guidance may affect them.

7. Payments and Refundable Credits

This section reports payments made toward tax liability, including:

- Estimated tax payments

- Credits applied from a previous year's return

- Refundable tax credits

8. Schedule L – Balance Sheets per Books

This section provides an overview of the corporation’s financial position at the beginning and end of the tax year, including:

- Assets

- Liabilities

- Shareholders' equity

9. Schedule M-1 – Reconciliation of Income

This schedule reconciles the corporation’s book income with its taxable income, explaining any differences due to accounting methods or tax adjustments.

Filing Form 1120 accurately is crucial for compliance and tax optimization. At CMP, we help corporations navigate this process efficiently.

How to Fill Out Form 1120 (Step-by-Step Guide)

Filing Form 1120 requires gathering financial data, reporting income and deductions, and calculating tax liability.

Note: The IRS updated the Form 1120 instructions for tax years beginning after December 31, 2024, including changes relating to CAMT guidance and updated credit/deduction rules. These instructions were updated November 2025.

Follow these steps for accurate filing:

Step 1: Gather Financial Records

Before completing Form 1120, collect essential documents, such as:

- Income statements and balance sheets

- Employer Identification Number (EIN)

- Records of gross receipts, sales, and expenses

- Payroll and business expense reports

- Previous tax returns (if applicable)

Step 2: Complete General Business Information

Provide basic details about the corporation, including:

- Business name, address, and EIN

- Date of incorporation and principal business activity

- Total assets at the beginning and end of the tax year

Step 3: Report Income & Deductions

- Income Section: Report gross receipts, returns, and allowances, and any other business income.

- Deductions Section: List business expenses such as salaries, rent, depreciation, and other deductible costs.

- Taxable Income: Subtract total deductions from total income.

Step 4: Calculate Total Tax Liability

- Apply the corporate tax rate (21% for corporations) to taxable income.

- Account for applicable tax credits to reduce liability.

- Include any additional taxes, such as the base erosion minimum tax (BEAT), if required.

Step 5: Complete Additional Schedules if Required

Certain corporations may need to file additional schedules:

- Schedule C: Dividends and special deductions

- Schedule J: Tax computation and credits

- Schedule K: Other information, including accounting method and shareholder details

- Schedule L: Balance sheets

- Schedule M-1 & M-2: Reconciliation of income and retained earnings

Ensuring accuracy when filing Form 1120 is essential for tax compliance and avoiding penalties.

When Is Form 1120 Due?

When operating a C-corporation, you can set your tax year to follow either a calendar year or a fiscal year, depending on your business needs.

For the 2024 tax year, Form 1120 is due on the 15th day of the fourth month after the end of the corporation’s tax year.

- Calendar Year Corporations: If the tax year ends on December 31, 2024, the due date is April 15, 2025.

- Fiscal-year corporations: The due date is the 15th day of the fourth month after the fiscal year ends.

If the deadline falls on a weekend or federal holiday, it moves to the next business day. Corporations needing more time to file can request a six-month extension using Form 7004. However, any taxes owed must still be paid by the original due date to avoid penalties and interest.

Penalties for Late or Incorrect Filing

Failing to file Form 1120 on time or submitting incorrect information can result in significant penalties, interest charges, and increased IRS scrutiny. Below are the key consequences corporations may face:

1. Late Filing Penalty

The IRS imposes a penalty of 5% of unpaid taxes per month (or part of a month) that the return is late, up to a maximum of 25%. If no tax is due, penalties may still apply for failing to file. Minimum late-filing penalty update: For returns more than 60 days late, the IRS imposes a minimum penalty equal to the lesser of the tax due or $510

2. Late Payment Penalty

Even if Form 1120 is filed on time, failing to pay the full tax amount results in a 0.5% penalty per month on the unpaid taxes, up to 25%. This penalty continues accumulating until the balance is paid in full.

3. Interest Charges

The IRS charges interest on any unpaid tax from the original due date until the tax is paid. The interest rate is based on the federal short-term rate plus 3%, and it compounds daily with no maximum limit.

4. Increased IRS Audit Risk

Filing late or submitting inaccurate information may trigger IRS scrutiny, increasing the likelihood of an audit. If discrepancies are found, additional penalties or legal action may follow.

5. Business Credit Impact

If unpaid taxes result in a tax lien, it can severely impact the corporation’s business credit score, making it more difficult to secure loans, obtain credit from suppliers, or engage in financial transactions.

6. Legal Consequences

In severe non-compliance or suspected tax evasion cases, the IRS may pursue legal action, which could result in fines or criminal charges. Willfully failing to file or underreporting income may lead to serious penalties.

7. Loss of Tax Benefits

Filing late can result in the loss of valuable tax benefits, such as the ability to carry forward losses or claim certain deductions. This can have long-term financial consequences for the business.

Common Mistakes to Avoid When Filing Form 1120

Filing Form 1120 requires careful attention to detail to prevent errors that could result in penalties, IRS audits, or missed tax benefits. Below are some of the most common mistakes businesses should avoid:

1. Misreporting Income

Failing to report all revenue sources or misclassifying income can lead to underpayment or overpayment of taxes. Underreporting may trigger an IRS audit, while overreporting could result in unnecessary tax payments.

How to avoid it: Ensure all revenue streams are accurately recorded and cross-check financial statements before filing.

2. Overlooking Allowable Deductions

Businesses often overlook deductions they qualify for, which can result in a higher taxable income and increased tax liability.

How to avoid it: Maintain detailed records of all business expenses and consult a tax professional to maximize deductions.

3. Errors in Tax Credit Calculations

Incorrectly calculating tax credits can result in missed savings or penalties for claiming ineligible credits.

How to avoid it: Keep thorough documentation of activities that qualify for tax credits and use accounting software or professional assistance to ensure accuracy.

4. Inconsistent Information Across Schedules

Form 1120 includes multiple schedules that must align with the main return. Discrepancies between them can raise red flags with the IRS.

How to avoid it: Use tax preparation software that auto-fills relevant sections and review all forms for consistency before submission.

5. Missing Signatures or Required Attachments

A missing signature or omitted document can delay processing and result in penalties.

How to avoid it: Use a checklist to verify that all signatures and required forms are included before filing.

6. Filing with Incorrect Business Details

Providing outdated or incorrect business information, such as EIN, business name, or address, can cause issues with IRS processing.

How to avoid it: Double-check all business details before submitting the return to ensure they match IRS records.

7. Incorrect Filing Method

Some corporations are required to e-file, and submitting a paper return when e-filing is mandated can lead to processing delays or rejections.

How to avoid it: Confirm the correct filing method for your business type and follow IRS guidelines.

8. Failing to Make Estimated Tax Payments

Corporations must typically make quarterly estimated tax payments. Failing to do so can result in penalties, even if no tax is owed at the time of filing.

How to avoid it: Set up a system to track estimated payments and ensure they are made on time each quarter.

Frequently Asked Questions About Form 1120

Filing Form 1120 correctly is essential for C corporations to stay compliant with IRS regulations and avoid costly penalties. Below are answers to some of the most frequently asked questions regarding Form 1120.

How Does Form 1120 Differ From Other Business Tax Forms?

C corporations use Form 1120 to report income and pay corporate taxes. In contrast, Form 1120-S is for S corporations, and Form 1065 is for partnerships. The main difference is that C corporations pay taxes at the corporate level, while S corporations and partnerships pass income through to shareholders or partners, who report it on their personal tax returns.

Can I File Form 1120 Electronically?

Yes, the IRS allows and encourages e-filing for Form 1120. Corporations with $10 million or more in total assets are required to file electronically. E-filing helps reduce errors and speeds up processing times.

What Records Should I Keep to Support My Form 1120 Filing?

Maintain financial records such as income statements, balance sheets, payroll records, expense receipts, and prior tax returns. The IRS recommends keeping these for at least three years from the filing date or two years after paying the tax owed, whichever is later.

How Do I Report Officer Compensation on Form 1120?

Report officer compensation on Line 12 of Form 1120, including salaries, bonuses, and benefits. Ensure compensation is reasonable based on industry standards, as excessive payments can be scrutinized by the IRS.

What If I Need to Amend My Form 1120 After Filing?

File Form 1120-X (Amended U.S. Corporation Income Tax Return) to correct errors. If additional tax is owed, pay it as soon as possible to avoid penalties and interest.

Should I File Form 1120 Myself or Hire a Tax Professional?

If your corporation has complex deductions, multiple income sources, or multi-state tax obligations, hiring a tax professional can help ensure compliance and maximize tax savings. Here are 5 key benefits of hiring a local CPA firm to support your small business.

File Form 1120 with Confidence—CMP Is Here to Help

Filing corporate taxes can be complex, and mistakes can lead to penalties, audits, or missed tax-saving opportunities. This guide has covered key aspects of Form 1120, but every business has unique tax obligations. Ensuring compliance and accuracy is crucial to avoiding unnecessary risks.

Need assistance with your Form 1120 filing? CMP’s team of experienced tax professionals is here to help. With offices in Layton, Logan, and St. George, we provide expert tax services tailored to your business needs. Schedule an appointment today and file your corporate taxes with confidence!