Whether you’re a business owner or just preparing to file your individual income tax return, it’s helpful to have tools that simplify the process and minimize the chance of errors.

At CMP, we believe it’s our responsibility to keep you apprised of new tax developments. One recent addition to the resources provided by the Internal Revenue Service is the Tax Withholding Estimator. Here’s what you need to know about it.

What is the Tax Withholding Estimator?

The Tax Withholding Estimator is a free tool on the IRS website that you can use to estimate the amount of tax that should be withheld from your paychecks. Getting your withholding right is essential because you may have problems if your employer withholds too little – or too much.

If your withholding is too low, then you may end with an unexpected tax bill or penalties when the time comes to file your taxes. If it’s too high, then you will take home less pay and won’t be able to use your money as efficiently.

The Tax Withholding Estimator is easy to use. You will not be required to provide any personal information, which means the calculator is secure.

Who Should Use the Tax Withholding Estimator?

The Tax Withholding Estimator may be useful for taxpayers in every income bracket. Here are some indicators that you should use the new tool to check your withholding.

- You have recently changed jobs or changed your tax filing status.

- You changed your withholding mid-year.

- You have recently experienced a big life change, such as getting married, having a baby, adopting a child, or buying a home.

You may also want to use the estimator if you feel that your refunds have been too big in the past and you want to use your money during the year instead of waiting for a refund.

What Information Do You Need to Use the Tax Withholding Estimator?

Using the Internal Revenue Service’s Tax Withholding Estimator is easy. You will need:

- Your most recent pay stub

- Your spouse’s most recent pay stub (if married and filing a joint return)

- Documentation of any income not listed on your pay stub

- Your withholding status

- Your most recent income tax return

You will not be required to enter any identifying information, such as your name, employer’s name, or Social Security Number.

How to Use the Tax Withholding Estimator

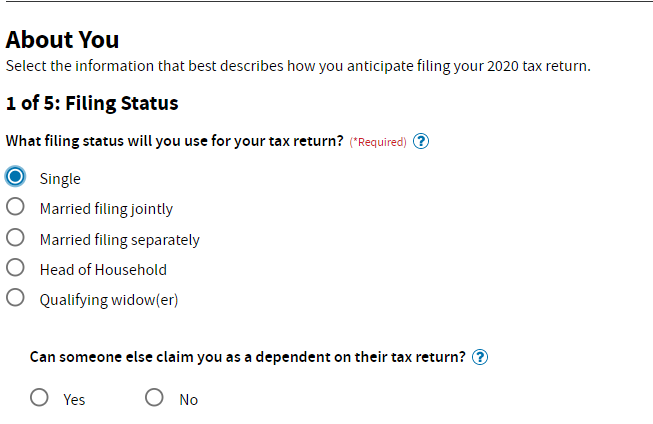

Using the Tax Withholding Estimator is easy. You can click here to get started. The first screen you will see looks like this:

You will need to choose the correct filing status and answer the question about being claimed as a dependent. When you do, the next section will appear.

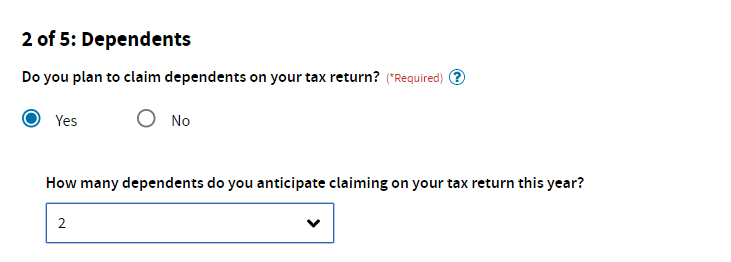

If you plan to claim anybody as a dependent on your tax return – whether it’s your spouse, children, or an elderly parent living with you, you should answer yes. Then, fill in the number of dependents you will claim to move on to the next step.

You may also want to read: Tax Credit for Elderly Parents Living With You.

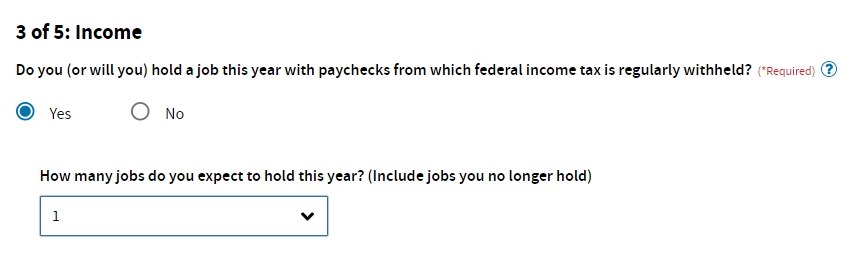

In this section, answer yes if your taxes are withheld from your paycheck. If you have started a new job – meaning that you will receive two or more W-2 forms – make sure to include every job you have held in the count for the second part of the question.

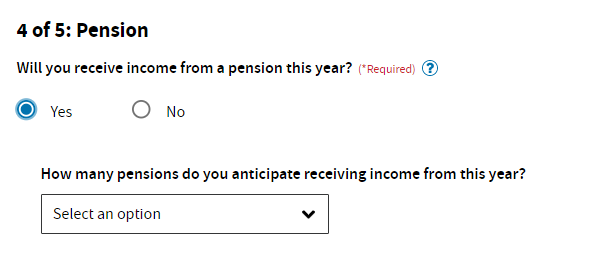

If you have one or more pensions that will pay you this year, answer Yes to this question and enter the appropriate number of pensions into the second box. If this question does not apply to you, simply answer no and move on to the next section.

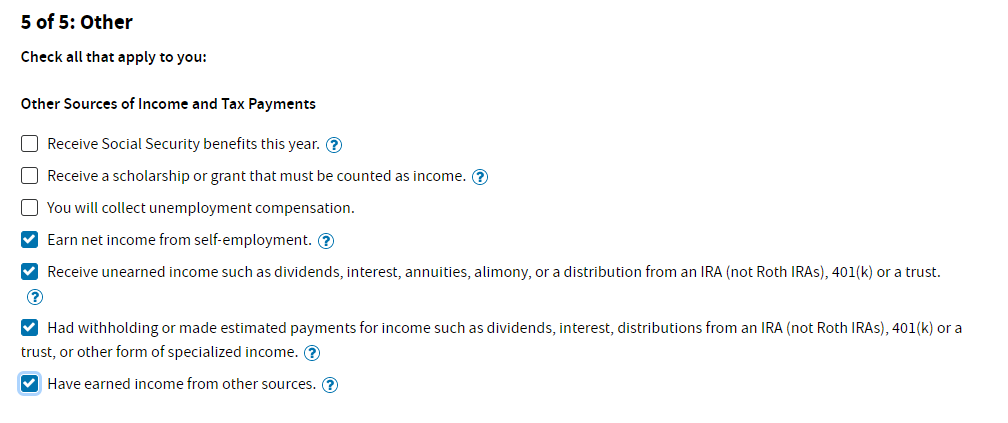

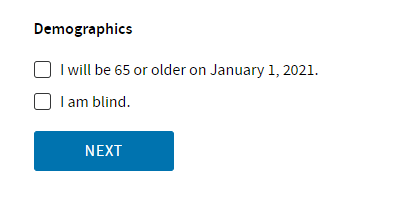

In this section, check every box that applies to you (and your spouse, if filing jointly.) You will also be given a chance to check one of these two boxes at the bottom of the screen:

The next screen that appears is the most involved section of the IRS Tax Withholding Estimator. You will be asked:

- If you expect to hold your current job for the remainder of the year

- How frequently you are paid (weekly, bi-weekly, monthly, etc.)

- The date your last pay period ended

- The total wages you expect to earn this year

- Any bonuses you have already received this year

- Any bonuses you expect to receive later this year

- Whether your employer will withhold taxes from your bonuses (yes/no)

- Tax amount withheld year-to-date

- Tax amount withheld on your most recent pay stub

- Whether you contribute to a tax-deferred retirement plan such as a 401(k)

- Whether you contributed to a pre-tax HSA, FSA, childcare credit account, or cafeteria plan

If you indicated any other sources of income, such as a pension or self-employment income, you would need to provide details of that as well. Then, you will need to answer questions about:

- Adjustments to your income

- Deductions (including whether you will take the standard deduction or itemize your deductions)

- Tax credits

In the end, you will get an estimate of your final tax balance for the year, whether it’s an overpayment (refund) or an underpayment (money you owe.)

What to Do with Your Tax Withholding Estimate

Once you have calculated your estimated tax withholding for the year, you can use the information to adjust your withholding as needed. In general, it is better to get more money in your paycheck and get a small refund than it is to get less money in your paycheck and a big refund when you file your return. The extra money in your paycheck can be used to:

- Contribute to a retirement accounts such as a 401(k) or a Roth IRA

- Contribute to a college savings account for your children

- Save for a down payment on your home

- Create an emergency fund for your family

Money that you invest at the beginning of the year will grow, whereas money that you pay to the government will stagnate until you get your refund.

Conclusion

The new IRS Tax Withholding Estimator is a useful tool for any taxpayer who believes their employer may be withholding too much or too little for their paycheck.

Need assistance with your income tax return? Contact us today to learn how CMP can help!