This post was originally published on October 25, 2019, and updated on March 30, 2020.

Running a small business requires business owners and their employees to multitask and be flexible.

QuickBooks Online is the most popular software for small business accounting and can help you track your finances. But if you’re new to using the QuickBooks small business features, it can take a while to get up to speed.

At CMP, our clients often ask us this question:

What are some QuickBooks tips and tricks for small businesses?

We’re happy to help. Here are some of our best QuickBooks tips for small businesses for you to try.

Easy QuickBooks Tips for Small Business Owners

Let’s start with the basics to help you use QuickBooks for your small business. Here are some simple tips to help you get started.

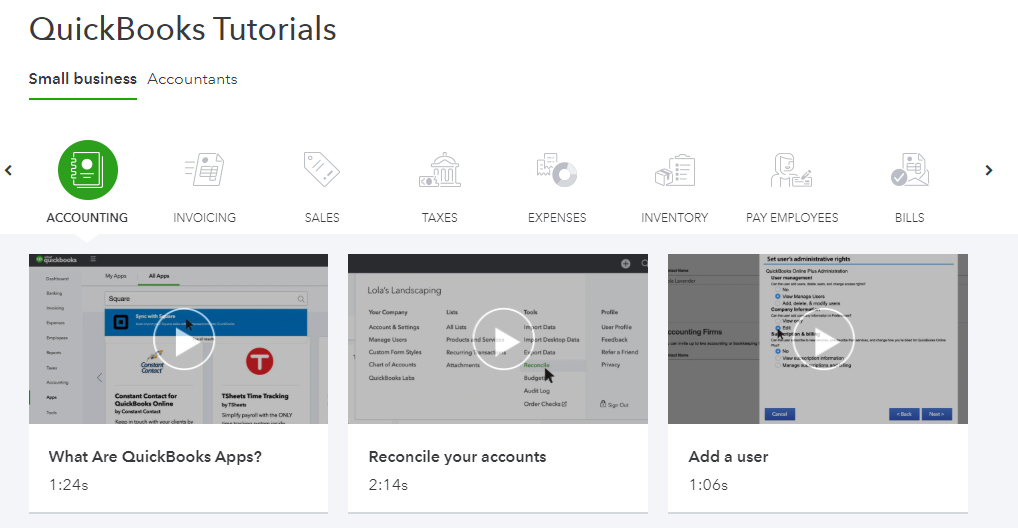

Use the Getting Started Tutorials to Learn Your Way Around

The first tip is a simple one. Intuit has built Getting Started tutorials into QuickBooks small business software and they’re a great way to learn the basics. Here’s a sample of some tutorials you will get:

As you can see, there are options to help you learn how to invoice your clients, track and pay your taxes, enter expenses, and manage inventory. Most of the videos are short, and they’re very straightforward and easy to follow.

Secure Access to QuickBooks

Since QuickBooks is where you’ll be entering your most important financial information, you must do what you can to limit access and secure your data. These two things will help keep your information safe:

- Go to the Accounts tab and set a secure password for your account. It should be a mix of upper and lower-case letters, numbers, and symbols. Avoid using words that someone might be able to guess. The best passwords are random.

- Assign users to your QuickBooks Online account and limit access to only the people who need it.

Limiting access and securing your information will minimize the risk of a data breach or intrusion.

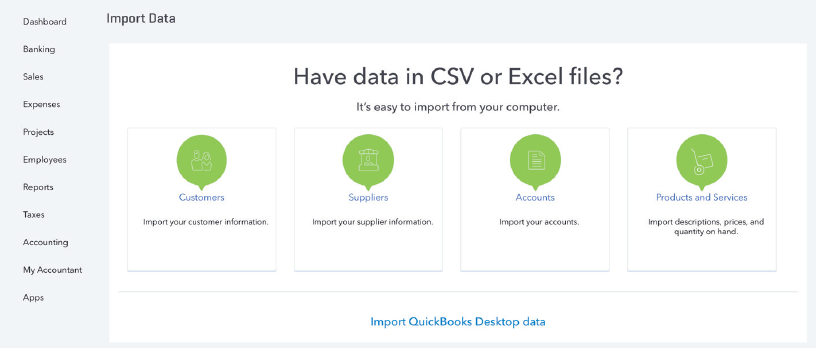

Use the Import Feature for Quicker Data Entry

One of the best small business QuickBooks tips we can offer is using the software’s input option to quickly add clients, suppliers, and other information to your account.

Your data must be in Excel or CSV format. Once you import your data, you’ll have a chance to correct any mistakes that may have occurred. This step can save you hours of data entry time and ensure that you are up and running quickly.

Pay Bills and Print Checks

One of our favorite things about QuickBooks for small businesses is that it’s an all-in-one accounting solution. You can use it to do everything, including paying your bills and printing checks.

If you sync QuickBooks with your business bank account, you can use it to make payments online. Online payments cost less than printing checks. Making those payments using QuickBooks allows you to streamline your journal entries and simplify the process.

Advanced Small Business QuickBooks Tips

After you have mastered the basics, it’s time to step things up and learn about advanced QuickBooks tools to help you manage your company’s finances. Here are some small business QuickBooks tips from our professional accountants.

Reconcile Your Entries

If you don’t reconcile your accounting and bookkeeping entries regularly, it can turn into a huge mess down the line when it’s time to close your books. One QuickBooks trick to try is to immediately reconcile any new information you enter.

Every time you get a statement or payment, you can use QuickBooks to quickly check and reconcile it. You’ll minimize mistakes and save yourself time in the long run.

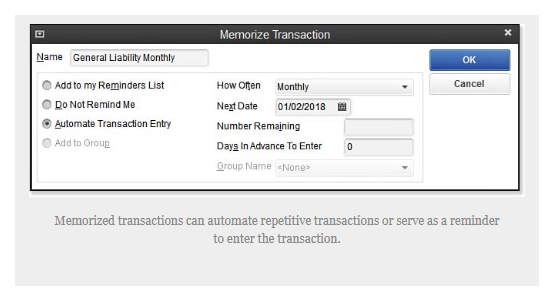

Memorize Transactions

You can use QuickBooks to “memorize” repeat transactions that you have to log every month, such as rent for your office space or insurance payments.. This feature allows you to enter a payment once. Then go to:

Lists>Memorized Transaction List>Memorized Transaction>New Group

Follow the above prompts to choose the transactions you want to memorize. You can use this feature for paying bills and issuing invoices for repetitive billing. You can also create automated transactions and set reminders.

Set Up and Track 1099 Vendors

Do you use independent vendors and contractors for some of your work? If the answer is yes, then it’s your responsibility to set up and track 1099 vendors and QuickBooks can help you do it.

You’ll be able to:

- Set up vendors

- Enter payments and sales tax

- Generate and send 1099 forms at the end of the year

This QuickBooks tip is an important one because it can keep track of vendor payments and save you hours of time at the end of the year.

View Transaction Histories

Even for people with some accounting experience, it can be difficult and frustrating to sort out transaction issues. Especially if you have received partial payments on an invoice or a client has disputed a charge.

With QuickBooks, you can easily view the transaction history for any invoice by going to Reports > Transaction History. Run a report for the transaction in question and you’ll be able to sort out any issues quickly.

Find Journaling Errors

When doing journal entries, you must enter a positive and negative journal entry for every transaction. This can be confusing, especially if you’re someone who doesn’t do journal entries on a regular basis.

Using the Transaction Journal (Reports > Transaction Journal) can help you view every journal entry in a format that makes it easy to spot errors and omissions. This one QuickBooks tip can save you hours of time.

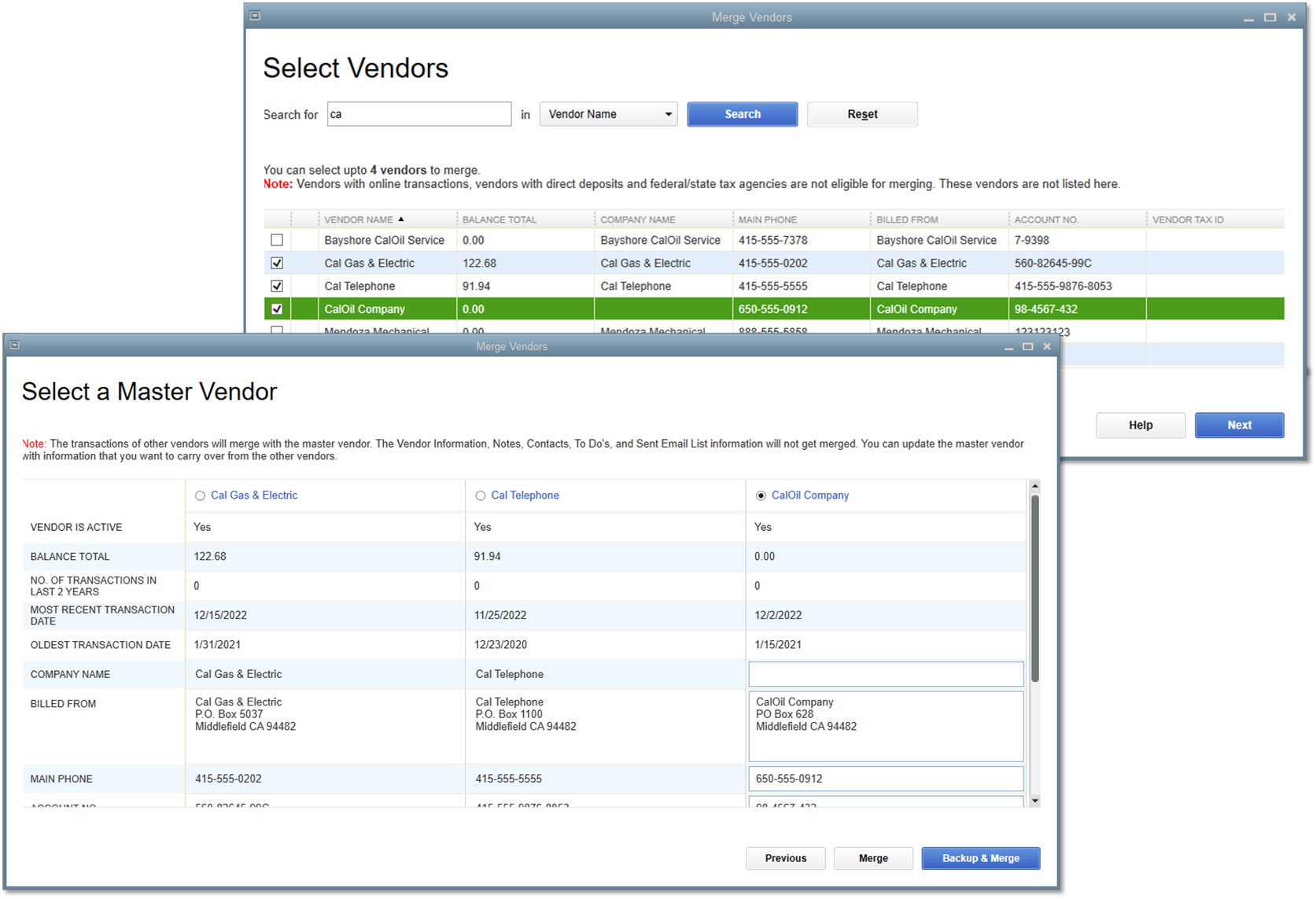

Merge Duplicate Accounts

When you’ve got multiple users on your QuickBooks online account, it is possible that you’ll end up with duplicate accounts in your system. This is a problem when it comes to keeping track of invoices and other transactions.

Using QuickBooks, you can simply choose one account and then identify the account you want to merge. Right-click on the account you want to retain to copy the name. Add it to the account you want to merge.

When you click Save, a prompt will display asking if you want to merge the accounts. Click yes and you’re done.

Merging accounts helps keep your records clean, but sometimes the bigger challenge is upgrading your entire system. If you’ve been thinking about migrating from QuickBooks Desktop to QuickBooks Online, our comprehensive guide shows you how to do it step by step, so you can streamline your books without missing a beat.

Conclusion

QuickBooks can help small business owners and employees do a good job of tracking their finances and growing their companies. These small business QuickBooks tips and tricks will help you make the most of your QuickBooks account and keep your business’s finances in order.

If you struggle to find time to handle your small business accounting, you may want to consider outsourcing your QuickBooks to a pro. Outsourcing can free up your time to handle other aspects of your business and minimize the risk of costly errors.

Do you need some help with QuickBooks? QuickBooks Pro Advisors are ready to help you with anything and everything QuickBooks-related.